As banks and financial institutions look to expand their use of AI in their operations, having compelling reasons to deploy the technology are now the norm. But a large challenge stands in the way of broadening the use of AI in the industry – it’s increasingly hard to find enough well-trained data scientists to help banks and financial services companies reach their AI goals.

That’s one of the main conclusions of a new “State of AI in Financial Services” survey conducted recently by Nvidia, which asked more than 200 global financial services professionals for their thoughts about AI growth opportunities, deployment models and investment plans for 2021.

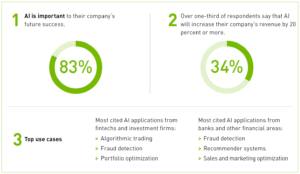

The growing value of AI use throughout the industry was quite apparent in the five-page survey report, with 83 percent of respondents saying that AI is important to their company’s future success. Meanwhile, 34 percent of the respondents said they believe that using AI will help their operations increase revenue by 20 percent or more.

Kevin Levitt of Nvidia

“Executive leadership across financial services is seeing a lot of AI news, and they’re hearing from their teams about the importance of AI,” Kevin Levitt, Nvidia’s global industry business development director for financial services, told EnterpriseAI. “But as you know, financial services find comfort in moving in packs and moving slowly. They want to know the questions and which use cases [to] prioritize,” as well as how to enable their teams for success.

Those leaders are also not alone, said Levitt, in trying to understand how to move AI trials out of their centers of excellence and into production, where it can deliver value to their companies in operations or customer experience.

To Levitt, the study’s finding that 83 percent of the respondents believe that AI is important to their company’s future success “solidifies where AI stands from a prioritization standpoint and how these financial professionals are thinking about it.”

Help Wanted: Data Scientists

At the same time, though, 38 percent of the respondents reported that one of their greatest challenges to reaching their AI goals is finding enough well-trained data scientists to hire and bring into their operations, said Levitt.

“Number one is that there are too few data scientists [in the marketplace],” he said. “These are highly sought after human capital resources and skill sets, and that’s because the banks are investing heavily in AI. This is where the differentiation is going to happen over the next three to five years, if not longer.”

The lack of qualified data scientists is a consistent theme heard from many customers, he said.

“The banks don’t necessarily need proof points anymore through proof of concept [trials],” he said. “The challenge that they’re having is how do they scale AI across the enterprise successfully. Because what’s happened is they’ve been a little behind in having a definitive strategy when it comes to AI.”

To try to solve those skills challenges, various departments inside banks and financial institutions have been working on these issues on their own, often through shadow AI efforts, said Levitt. In these cases, the credit card division, the retail banking division and the home lending division might have their own teams that are trying to do their own development work.

“That’s where we see a lot of the conversations we’re having with executive leadership today, including how do they build and enable their kind of infrastructure to support the growing demands of the enterprise from an AI perspective,” said Levitt.

Analyst Jack Gold

Jack E. Gold, the president and principal analyst with J. Gold Associates, LLC, echoed the impacts of the data scientist shortage in hiring pools today.

“While all firms are trying to hire more of them, there are too few to go around, and they are expensive due to high demand and skill sets,” said Gold. “What’s really required is next-generation AI tools that can bring AI to the line of business managers, much like [Microsoft] Word made everyone a publisher, or Excel made everyone an accountant. Without this level of automation, there is no way that companies, especially smaller ones, can deploy AI to meet all of their needs.”

Some Hope for AI Tools to Help Fill Talent Gaps

One thing that could minimize the data scientist shortage are efforts from some vendors that are working to provide low-code or no-code AI tools to empower “citizen data scientist” expertise among non-developers inside companies, said Gold. “There is still a long way to go. I expect it will be at least another 2-3 years, and perhaps longer, before we can get to the mass production phase that enables anyone to use AI anywhere in the organization and for any purpose.”

Gold said the other study data is consistent with what he sees in the marketplace as well. “Right now, the biggest deployments of AI are the ones with the most potential paybacks. For banks and financial services, that is fraud detection, which is a huge loss for many, and trading of stocks, bonds, money markets, etc. Since the potential payback is so high, from millions to billions of dollars, the banks and financial firms are investing in these areas.”

The continuing use and shakeout of AI in banking and financial services is still an evolving trend, said Gold.

“Bottom line is for those companies that can spend big due to being able to recoup that investment, AI is a viable tool today,” he said. “But for many others, it’s still just a promise that will require simplifying steps before being achieved. It’s not about the compute power, which is easily available in the cloud. It’s about the algorithms and programs and learning/training that is the difficult part.”

Analyst Addison Snell

Another analyst, Addison Snell, the CEO and principal analyst of Intersect360 Research, said that while a lot of the early talk about AI focused on speech recognition and self-driving cars, the financial services industry was a big mover in production deployments in a big way.

“Investment banks, insurance companies and hedge funds are usually secretive about their proprietary applications, but there are clearly areas where AI is augmenting or even revolutionizing ways in which high-performance computing (HPC) is applied to finance,” said Snell. The financial services industry is the biggest commercial consumer of HPC infrastructure, with about $4.7 billion in 2020 spending. Short-term variability due to COVID-19 makes direct comparison tricky, but at pre-pandemic levels, financial services purchased nearly as much HPC as automotive and aerospace manufacturing and oil and gas exploration combined.”

In the finance industry, where HPC is used in algorithmic trading, risk management, pricing and determination of rates, as well as in analytics, the potential use of AI is everywhere, said Snell. “Any one of these can be improved by AI. Consider monitoring claim patterns for enhanced fraud detection or monitoring multiple markets for predictive downstream effects. In the extreme, we could eventually see tranche-based risk and pricing models replaced by individualized analytics, responsive to real-time market conditions.”

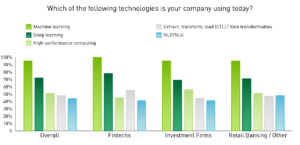

Snell’s comments mirror the study, which found the top use cases for AI among fintech businesses and investment firms to be algorithmic trading, fraud detection and portfolio optimization. For banks and other financial services organizations, the top use cases include fraud detection, recommendation systems and sales and marketing optimization. The study respondents included C-suite leaders, managers, developers and IT architects.

For fintechs and investment firms, the biggest positive impact of using AI has been in yielding more accurate models, which helps create competitive advantages and contributes to creating new products, the survey reported. For commercial and retail banks, the biggest gains from AI are coming through improved operational efficiencies.

This article originally appeared on EnterpriseAI.